Expert Services

Comprehensive Compliance Solutions

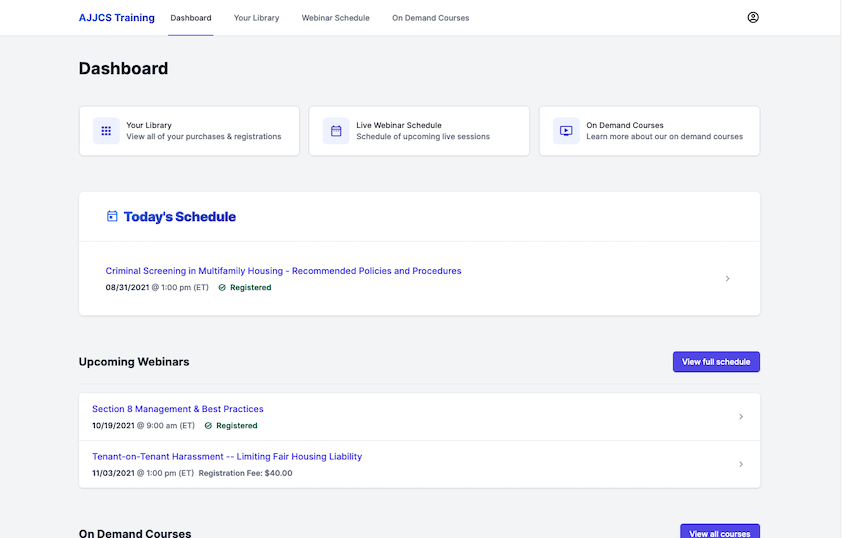

Staff Training

Empower Your Team

Comprehensive training programs designed to equip your staff with the knowledge and skills needed to maintain compliance and operate efficiently.

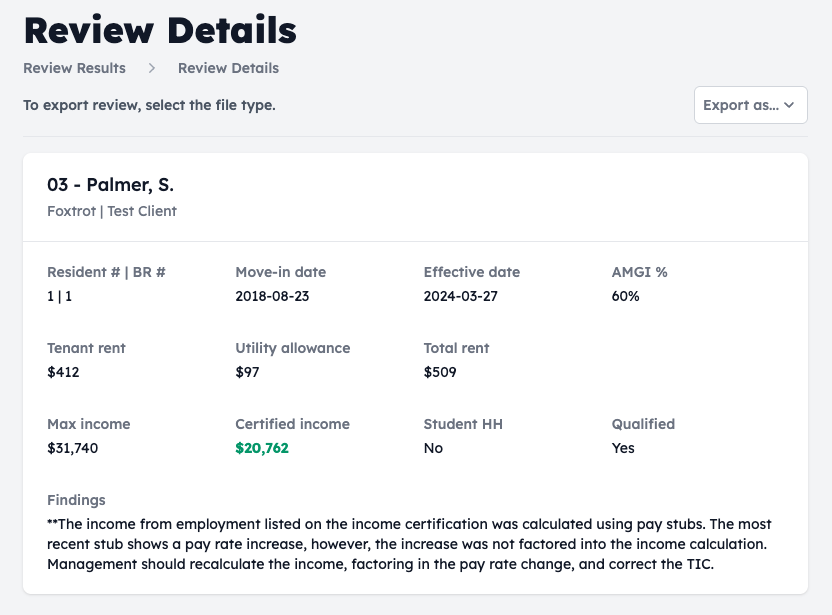

File Reviews

Detailed Compliance Audits

Thorough review of resident files and property documentation to ensure compliance with program requirements and identify areas for improvement.

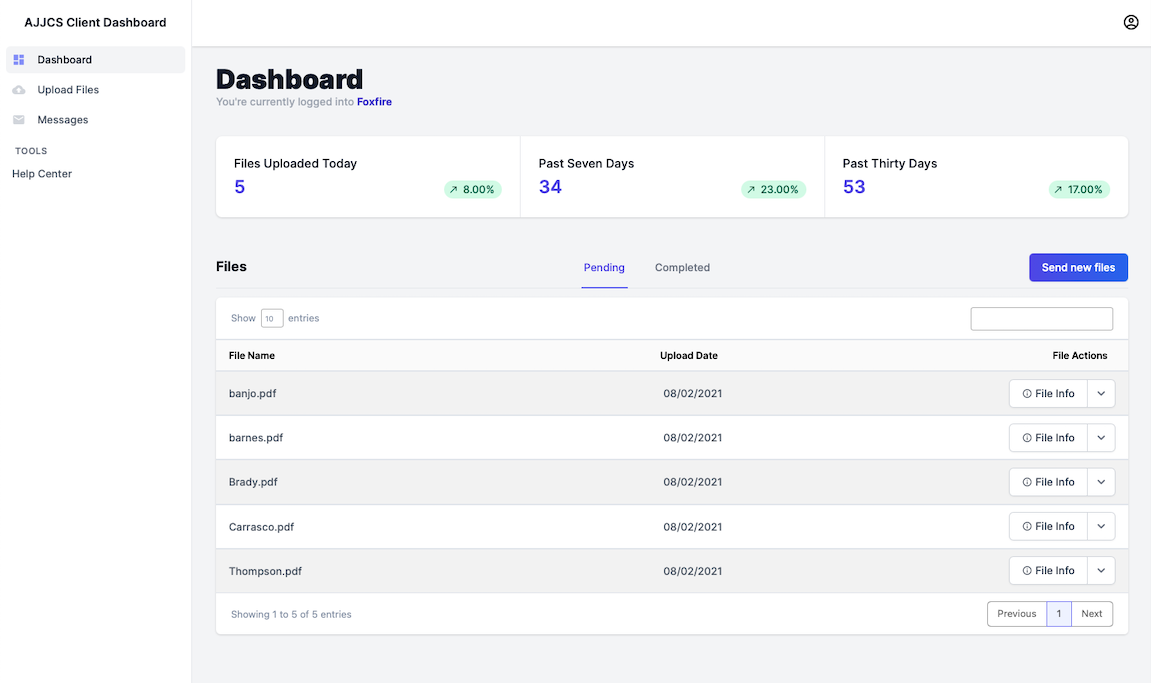

Compliance Monitoring

Expert Oversight & Documentation

Comprehensive monitoring services ensuring your properties maintain compliance with LIHTC, HOME, and other program requirements through detailed inspections and documentation.